Why investors favored even relatively new tech companies to established insurance giants in 2016?

According to a survey conducted by Fortune1 in the early part of 2016, Amazon emerged on top of a list of most trustworthy companies in the US. Technology majors Google and Apple were not far behind at positions 7 and 8 respectively.

Consumers are entrusting advanced technology companies with increasing amount of data about their lives in the bargain for more personalized products and services. This is resulting in a change of guard across industries where new age companies are overpowering their traditional counterparts. My sense is that insurance, an industry as established as it can get, is by no means exempt from this trend.

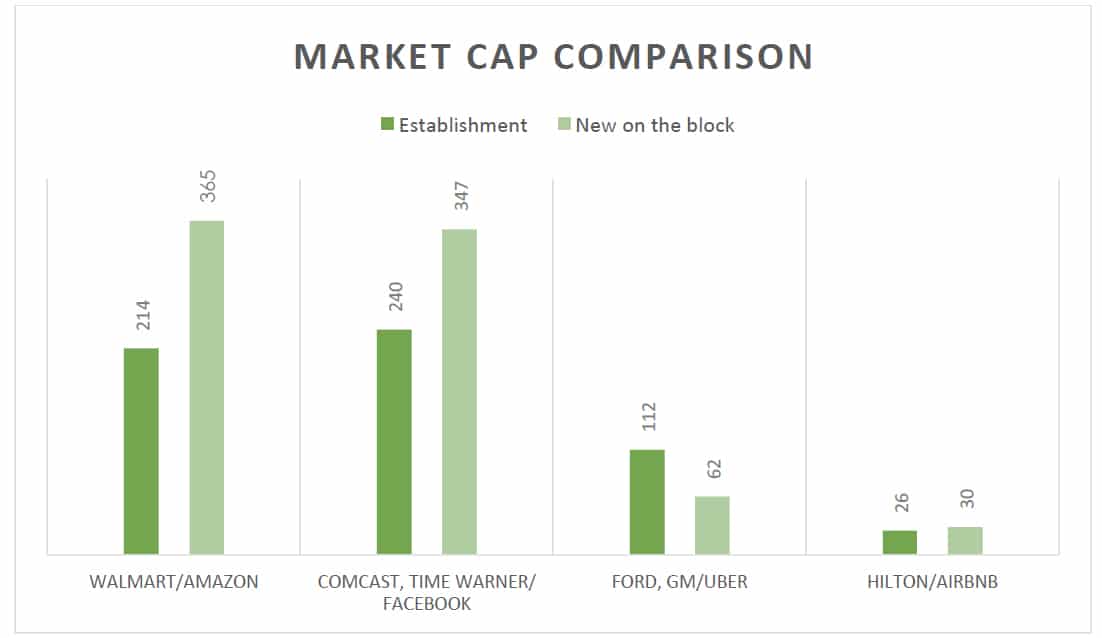

The establishment companies are being hugely overshadowed.

Not only consumers, but also markets and investors are less in favor of the conventional order. Take into account the comparison of the market caps of technology companies with traditional companies. The outlier in each of these industries does not own physical infrastructure such as stores3, cars, real estate and fiber optics. Still each one of them overshadows its counterpart that owns physical assets by a comfortable margin. What they have amassed over time is rich behavioral data on consumers, which is now worth its weight in gold.

If we overlook what this popular vote means for the insurance industry, we are in danger of being rudely disrupted. That said, it is worth examining what these companies are doing differently.

See also: https://www.intellectseec.com/follow-the-money-sniff-out-a-pattern/#.WH3n17TP_Io

CONVENIENCE

Within the comfort of their temperature-controlled homes, consumers easily perform day-to-day tasks such as ordering groceries or hailing an Uber with just a couple taps on their mobile phones.

However, this remains painfully untrue of insurance. Customers most often do not have the option of buying policies online. Advisors still deal with a ton of paperwork and lengthy customer onboarding processes. They continue to use rudimentary forms of technology such as excel sheets, and one-card systems to manage customer data. Carrier technology systems are complex and operate in silos.

TRANSPARENCY

Reviews of drivers on Uber and Lyft help build a trust system. Online shopping allows consumers to go through comprehensive product descriptions, view dynamic 3-D pictures, look up prices, compare options, check out product reviews, and get easy refunds. These aspects along with immediate gratifications, lend online retail its credibility.

On the contrary, buying insurance involves a lot of paperwork, something that younger customers don’t have patience for. The reliance on advisors to propose products that are best suited for a customer remains to this day.

However, advisors don’t have a scientific way of arriving at the product that takes into account the life stage as well as the life and financial goals of a customer, while complying with changing regulatory requirements. This no doubt creates a lack of transparency and trust.

BRING BACK TRUST, BRING BACK CUSTOMERS

The progressive agenda for insurance is to adopt modern technology coupled with artificial intelligence to mine relevant information (both big data and internal) at various stages of insurance. Insurers should up their game on advisor and consumer technologies. Table stakes today include an omni-channel and continuous experience across advisors, customers and service representatives. The product offerings for insurance being largely complex, customers still rely on advisors to guide them to the best-suited options. Advisors need to be equipped with smart technologies for pre-qualification of leads. They need insightful customer information to have targeted conversations even at their very first meeting with a lead.

Lemonade4, the New Renters and Homeowners Insurance, pays a claim in 3 seconds – this is a game changer. A shift in mindset and business models has to occur for the success of insurers and advisors. Technology should be exhaustively applied across the spectrum of insurance so customers and advisors have maximum real time capabilities and continuity across multiple channels and devices.

Laila Beane

Chief Marketing Officer & Head of Consulting – Intellect SEEC

Laila Beane is the Head of Consulting and Chief Marketing Officer at Intellect SEEC. She has successfully led key client engagements and presales, and product evangelism. She is a highly accomplished leader with 20+ years of experience and has held various leadership positions at ACORD and Allstate.

Source:

- The most trustworthy companies of the Fortune 100, https://www.surveymonkey.com/mp/measures/business/fortune-100-trustworthy/

- Market capitalization captured on Dec 12, 2016, https://www.bloomberg.com/markets/stocks

- Amazon has ventured into physical bookstores in the US, http://www.latimes.com/fashion/la-ig-fashion-style-retail-amazon-brick-and-mortar-20161014-snap-story.html

- Lemonade Sets New World Record, https://www.linkedin.com/pulse/lemonade-sets-new-world-record-daniel-schreiber